Overview

With the peanut planting season still ongoing, at about 90-95% done, there is a belief that the area will increase from 10% to 15% compared to last year’s.

Growers and exporters are expressing growing concern as heat waves in October and November have disrupted and interrupted plantings, pushing the completion of planting activities into early December.

Market prospects for selling remaining peanut stocks have become challenging due to significantly lower offers from China and India to Russia, together with a limited domestic market demand.

Despite these unfavorable conditions, peanut farmers are still asking for considerably high prices for their stocks of inshells, at about 22,4 USD per 25 KG bag (0,9 USD/KG).

On the export side, October figures show a decrease for both grain and oil exports compared to last month and to October 22.

Tables, charts and analyzes below:

Peanuts

Total

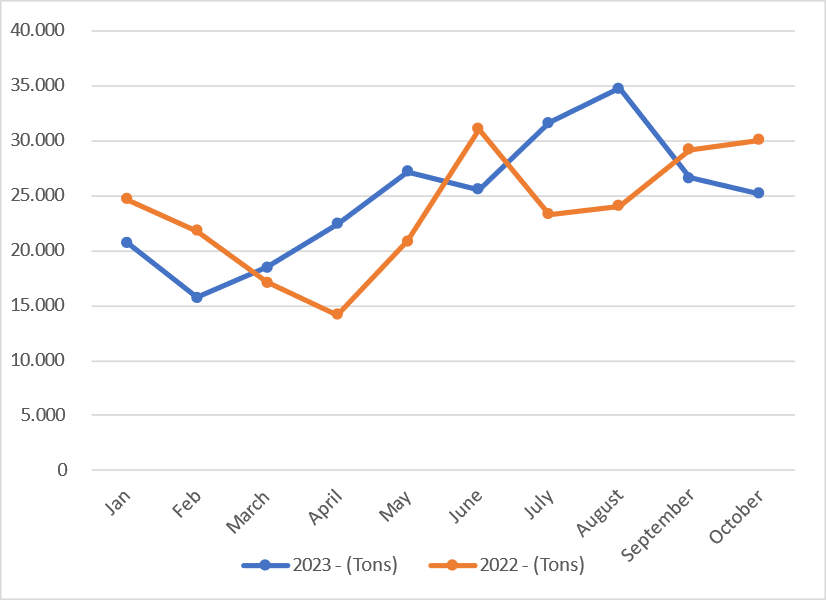

Peanuts export in 2023 x 2022

| Month | 2023 - (Tons) | 2022 - (Tons) | Var (%) |

| Jan | 20.702 | 24.698 | -16,18% |

| Feb | 15.756 | 21.798 | -27,72% |

| March | 18.472 | 17.132 | 7,82% |

| April | 22.425 | 14.161 | 58,36% |

| May | 27.193 | 20.885 | 30,20% |

| June | 25.542 | 31.055 | -17,75% |

| July | 31.630 | 23.327 | 35,59% |

| August | 34.730 | 24.030 | 44,53% |

| September | 26.620 | 29.200 | -8,84% |

| October | 25.150 | 30.057 | -16,33% |

| Total | 248.220 | 236.343 | 5,03% |

The numbers seem to be inverted when comparing this year’s exports to last year’s. The continuous decrease in the last two months might be explained by the decreasing demand in Russia, that is being supplied by China and India, although we shall see that more clearly in the next months numbers.

There was a decrease of 5,5% compared to September 23 and 16,32% compared to October 22. This amount to 248K tons exported in 2023, against 236K in 2022 a 5% increase.

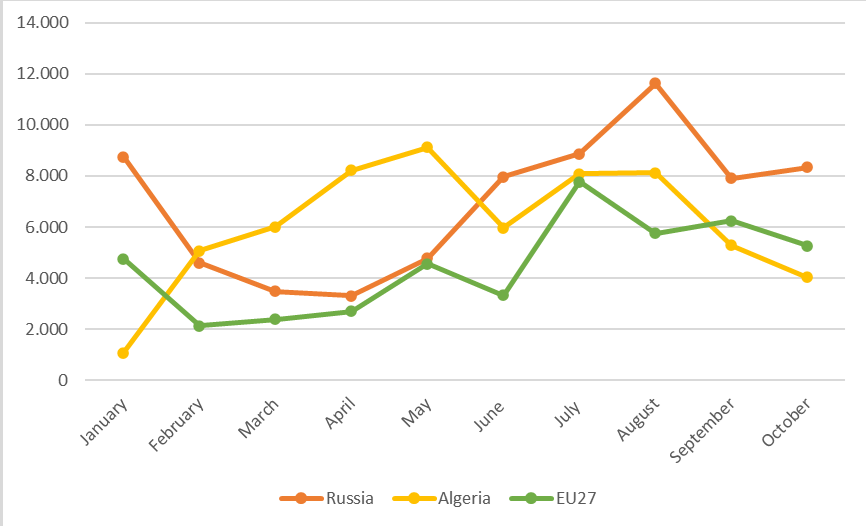

Destination

| Months | Russia | Algeria | EU27 |

|---|---|---|---|

| January | 8.754 | 1.077 | 4.758 |

| February | 4.594 | 5.065 | 2.118 |

| March | 3.473 | 6.000 | 2.385 |

| April | 3.300 | 8.215 | 2.686 |

| May | 4.781 | 9.123 | 4.549 |

| June | 7.965 | 5.973 | 3.320 |

| July | 8.865 | 8.077 | 7.777 |

| August | 11.630 | 8.132 | 5.761 |

| September | 7.900 | 5.290 | 6.250 |

| October | 8.333 | 4.025 | 5.271 |

| Total | 69.594 | 60.977 | 44.876 |

Unless the farmer’s stock decreases, I believe it will be very hard for the exporters to turn tables and be able to compete with the Chinese and Indian offers to Russia.

It seems obvious that China and India can’t supply all demand, especially because many importers prefer Brazilian peanuts’ characteristics, however, they can certainly grab a good part of it.

Exports to Algeria and EU27 have decreased, but the decrease in the EU27 certainly has a relationship with a decrease of exports to Riga and Tallin.

Peanut Oil

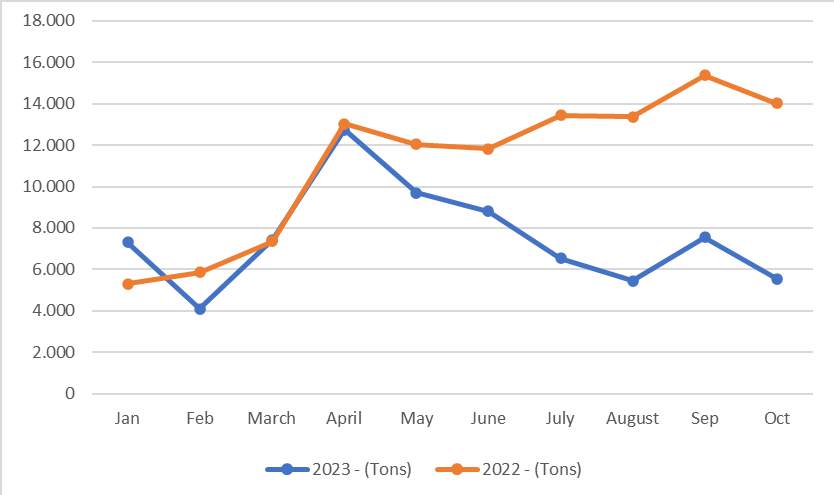

Peanut Oil export in 2023 x 2022

| Month | 2023 - (Tons) | 2022 - (Tons) | Var (%) |

|---|---|---|---|

| Jan | 7.298 | 5.301 | 37,68% |

| Feb | 4.092 | 5.852 | -30,08% |

| March | 7.439 | 7.359 | 1,08% |

| April | 12.746 | 13.023 | -2,12% |

| May | 9.706 | 12.045 | -19,42% |

| June | 8.807 | 11.836 | -25,59% |

| July | 6.543 | 13.446 | -51,34% |

| August | 5.456 | 13.364 | -59,17% |

| Sep | 7.555 | 15.370 | -50,85% |

| Oct | 5.544 | 14.023 | -60,46% |

| Total | 75.186 | 111.618 | -32,64% |

After a slight increase in September, peanut oil exports fell back to August levels, a decrease of incredible 60% compared to 22 October. This sums up to 75K tons exported this year, a 32% decrease, when compared to the same period last year.

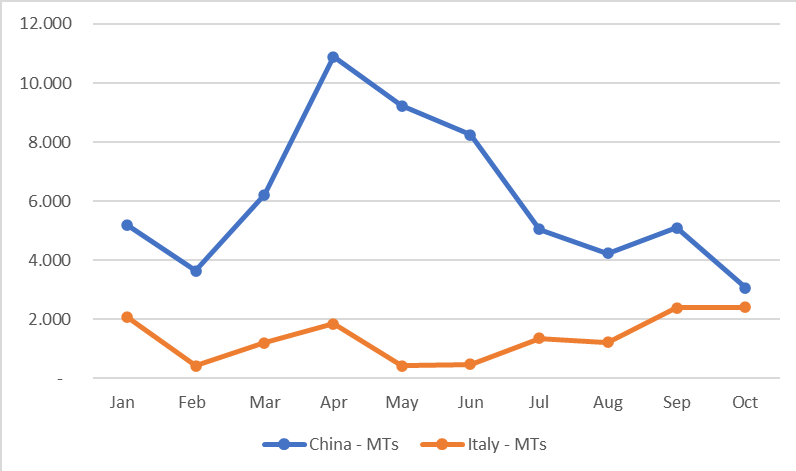

Destinations

Exported volumes to main destinations so far:

| Month | China - MTs | Italy - MTs |

|---|---|---|

| Jan | 5.203 | 2.094 |

| Feb | 3.649 | 433 |

| Mar | 6.225 | 1.213 |

| Apr | 10.890 | 1.855 |

| May | 9.235 | 434 |

| Jun | 8.250 | 485 |

| Jul | 5.042 | 1.365 |

| Aug | 4.230 | 1.224 |

| Sep | 5.100 | 2.400 |

| Oct | 3.070 | 2.406 |

| Total | 60.894 | 13.908 |

By looking at the destinations, it’s clear to see that the only responsible for the decrease compared to last month is China’s imports, as Italy imports remained incredibly steady.

Hope the report is useful to you.